How Does Evidence Help Your Trading? Discover Through a Detailed Trade Review

A lack of evidence often accompanies poor trades.

Trading with insufficient evidence leads to increased outcome variability due to omitting various crucial circumstances.

What comes next?

Excessive variability hinders the development of reliable and consistent trading strategies. But it also takes an emotional toll.

This lack of evidence fuels indecision and anxiety during trades, making an already challenging endeavour even more demanding. Agree?

But even though uncertainty is fundamental to trading - evidence stacking builds confidence - helping you overcome indecision and the discomfort of not knowing the market's next move.

In a minute

You'll see how stacked evidence improves outcomes and combats indecision and the uncertainty of being in a live trade. Let's go!

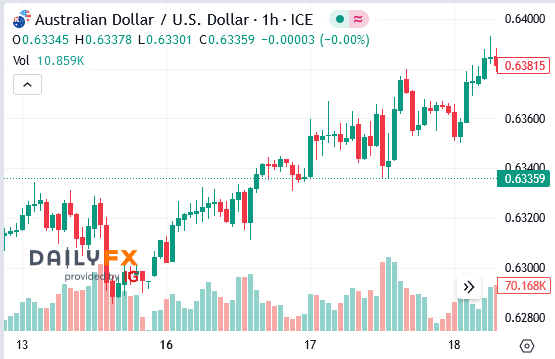

The 60-minute chart below indicates a strong upward trend in the Australian dollar. (Chart by FXSTREET)

A deep dive into inventory positioning tells you despite the market closing sharply lower the prior week - significant buying accumulation days before was 'unfazed' by the end-of-week drop in price. They continue to hold their new acquisitions.

Conclusion

If institutions have been buying aggressively and few are willing to transact at prices below their buying - all indications suggest a market bottom (in the short term). Agree?

Notably, the market has surged 100 basis points. Should you buy?

Context is king

There's no denying price is trending upward.

And considering the volume traded it confirms 'value' is rising. Yet the following trade centres around a short opportunity.

First

While it's true price always comes back to value - in the short term - it can do anything.

This holds particularly true when influential market participants are absent in anticipation of news releases.

Pending is a slate of economic releases from China.

Therefore it's plausible to consider a move counter to the current upward trend due to:

Weak-handed longs being shaken out, and/or

The opening of markets in other regions prompting a reduction in exposure (selling) in anticipation of economic data.

What does the evidence say?

In a second you'll see analysis derived from uncommon trading methods. These concepts and analysis are not easily accessible to most people - which makes them reliable.

But it's not important to grasp how each evidence point is calculated. Your takeaway is how powerful stacking evidence is as a robust trading approach.

With that in mind

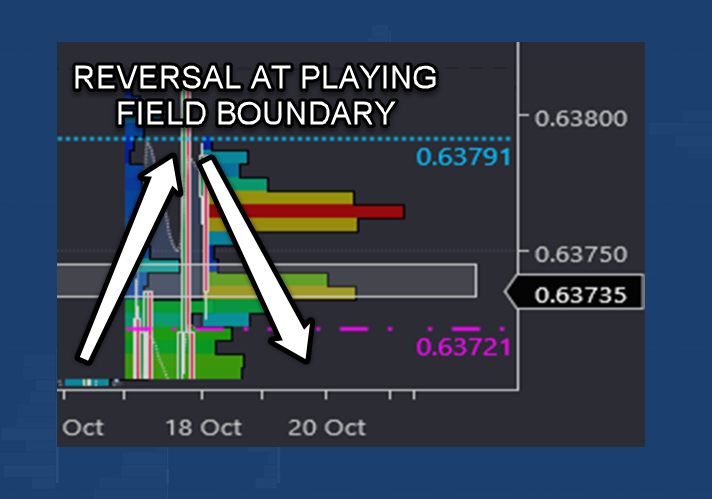

The first step is identifying where you can and can't trade through trading playing fields.

This considerably diminishes the likelihood of entering or holding a trade at a level where the price might reverse against you.

With the market trading at 0.6374 - that's a green light to trade.

What follows are several points of supporting evidence. As supporting evidence - they're not your ticket to enter the trade - they're merely building a strong case for a short trade.

In the chart below, not only is price trading within the permissible trading field, it's also showing:

- Price failed to break above a key relative value level unique to the traders operating in the Asian time zone. This is considered to have 'bearish' consequences in the short term.

- A large group of aggressive sellers are now 'onside'. For aggressive buyers positioned above this level, the expectation of short sellers getting trapped and pushing prices higher is no longer a viable strategy. Make sense?

- When the price fails to break a playing field boundary - it often reverses. It's an incredibly reliable trade strategy if you're stacking evidence multiples. As such it serves as a third point of evidence.

- When sellers and buyers go head to head and sellers are the victors - sellers are 'offering the market lower'. When this occurs below a proprietary calculation - the Pre-Pro Low™ - it provides additional evidence supporting price moving lower.

- When sellers offer the market lower below a key level commercial hedgers pay attention to - it acts as further evidence supporting lower price movement.

You identify the above points of evidence during your daily trading game planning. So you're not under time pressure to identify everything on the spot.

However the next step is identifying additional evidence points in real-time - enabling you to 'connect the dots' for a high-probability trade.

The chart below displays the execution, following the preceding seven additional points of evidence.

Note: specific details are not disclosed in the interest of maintaining a competitive trading advantage. This extends to the rationale for the final exit.

Remaining points of evidence

Behaviours align with an additional data-backed playbook trade.

A 2nd and 3rd deviation theme of a unique VWAP calculation is in play.

A downward price skew exists on two collaborating uniquely configured views (which is bearish).

Price is currently trading below CME and a unique VWAP calculation.

Price is consistently positioned to one side of the EMA's on a unique view (specifics not disclosed).

Sellers hitting bids is pushing the market lower (real-time tape reading).

A seasonal covering move is currently impacting price owing to the opening of another regional market (specific details not disclosed).

Less apparent is the role stacked evidence plays in timing your entries to maintain 'tight' risk.

Maintaining tight risk allows you to scale up your relative position size, leading to more substantial payouts without relying on significant price movements in the market.

This plays a vital role in achieving consistent performance because smaller moves in price are more likely to occur over chasing large moves.

Imagine only taking trades with a minimum of 10 points of evidence.

Now you're filtering trade selection for a selection of trades each day with the highest odds of success. You remove the negative impact of sub-par trades and over-trading - enhancing performance and self-confidence.

Further

As your timing improves you alleviate the anxiety of enduring trades that immediately go against you. Make sense?

But 10's a lot! And 7 are in real-time?

Ever watched a drummer using two feet and two hands independently?

Drummers start with the hands. The incorporation of their feet is introduced gradually.

Similarly

If you commence with 4 points of evidence - over time observing 4-5 points of evidence while executing trades becomes automatic. Once you reach this stage you can gradually incorporate additional points - aiming for 10 or more per trade.

To clarify

Having only 4 points of evidence does not provide the same level of robustness and odds as stacking 12 points of evidence.

But think of it like this...

When you're entering a trade based on 10 or more points of evidence - how many other people you're competing against are doing the same? Exactly!

This should serve as your incentive to strive for 10 points or greater.

Related reading:

For further insights into 'tight' risk management and sizing strategies check out:

Trading 1 Lot for 100 Points or Trading 100 Lots for 1 Point - Which One Should Be You?