The Trading Strategies That End Impatience, Flipping Trades, and FOMO

You curse yourself for making trading blunders.

Also, anytime you lack patience, FOMO into positions or change your trade direction on a whim.

Keep reading to discover how combining three valuable insights can end regretful trades for good and instil confidence about your future trading.

Insight one

Before entering a trade, you always want to ask yourself, "Is the outcome known?"

I'm sure you understand the saying, "Buy the rumour, sell the fact".

Regardless of what you trade and the different methods used by institutions, algorithms, and market makers, this principle applies to everyone in the market.

Let me give you a quick example using Friday's trading.

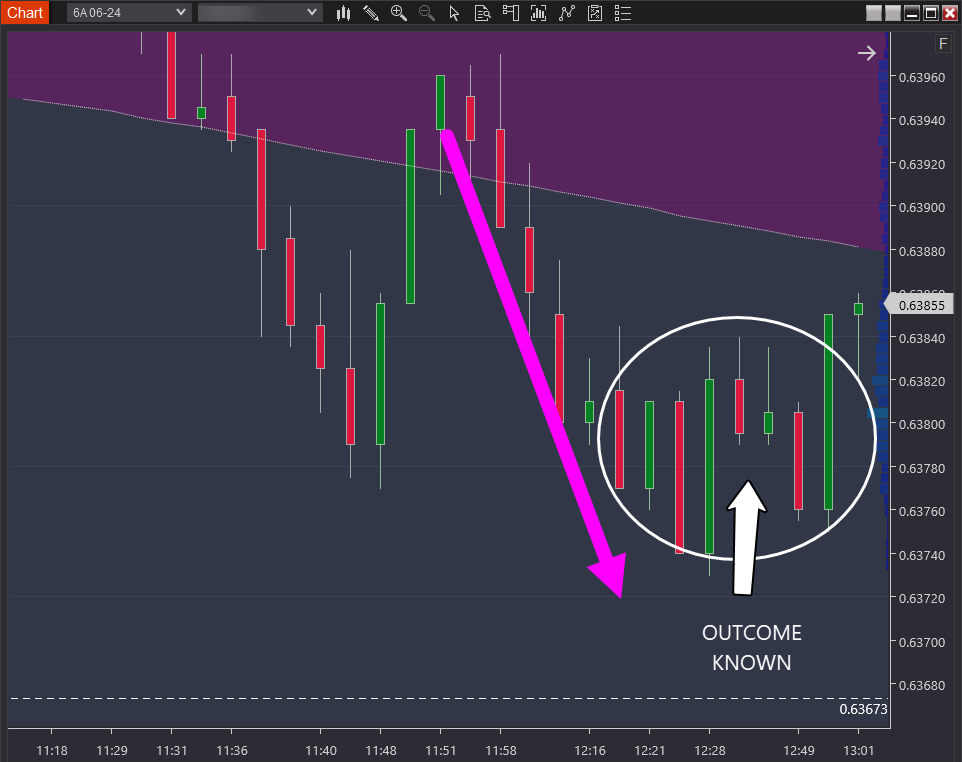

The first chart below shows a 'zoomed-in' view of the executions—only trading the short side.

The following chart you'll see is a 'zoomed out' view.

For context

The most successful blow in boxing is the "blindside punch"—a sudden, unexpected strike that the opponent didn't anticipate.

Similarly, the most successful market moves to trade are the unexpected moves that catch people off guard, using the element of surprise to gain an advantage. The pink arrow you see is the move down traded per the executions above—catching people off guard.

The white-circled area displays a stark contrast in behaviour. It refers to the 'outcome is known' when everyone in the market realises, "Geez, well, there's been a big move down." This period is by far the most challenging period to trade.

Why? Because there is a multitude of opposing views. Some are emotional, some flawed logic, but the outcome is akin to watching a tug-of-war that's a stalemate. Just as you think the team on the left has the upper hand, momentum shifts back to the right, and so on.

Successful trading requires entering your trade before 'the outcome is known' and exiting once known.

Exiting once the 'outcome is known' maximises your winnings. By contrast, setting a target is ineffective in capturing profits. You either exit too soon or give back open equity. Agree?

Insight two

Write this insight on a Post-it note and attach it to your monitors until it's deeply ingrained.

The market needs people to act irrationally and seemingly randomly to fund traders who understand how the game is played.

The most common time you'll witness this behaviour is when the outcome is known.

Consider this

When the market catches traders off guard, it's flush with traders exiting losing positions. You are not witnessing an even distribution of varying views and strategies in action.

But once the dust settles and the outcome is known, you'll see trading activity representing various views and strategies.

These are the optimum times for the market to capture profits from 'you' to fund the traders who understand how the market functions. Make sense?

When you deeply understand this, your participation completely transforms. You no longer fight with the market as if fighting against the market can ever work in your favour.

Instead: These are the periods when you know the market is executing its playbook to take money from unsuspecting traders.

And the longer it takes to execute its playbook on the unsuspecting, the bigger the number of traders it's capturing as the source of fuel for—you guessed it—the next 'before the outcome is known' event.

If there's one thing the market does with repetitive consistency, it's executing its playbook.

This means that your good idea (a game plan) can pay you several times over.

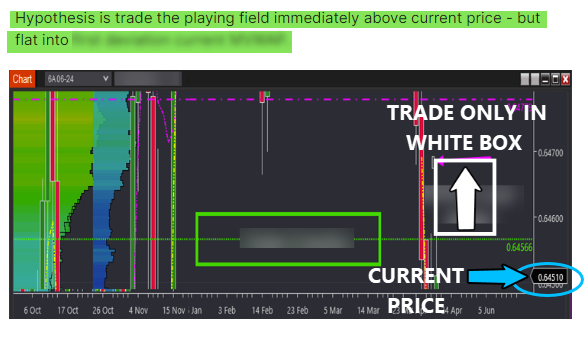

Let me show you using Thursday's game plan.

If the market moves from its current level, reaching the white-boxed area, trading on the long side is triggered.

The charts below show two opportunities to execute the above game plan.

The first time at midday and the second at 4 PM are examples of trading before the outcome is known.

And what about the period between them? Its classic outcome is known behaviour.

These periods can feel like they last a lifetime. But it's part of the market's playbook. Time for you to grab the popcorn and watch the show.

Full disclosure: I attempted three scalp trades between the two trade sequences above and lost on all of them.

Insight three

When you incorporate a multiple-points-of-evidence approach to trading and implement authentic playbook trades, you'll discover your trading opportunities don't coexist with the market's playbook. It's your ultimate defence against the market.

People often focus on finding trades to make money. But the secret to trading success is disqualification—and professionals know it.

You can filter out all the 'outcome-is-known' scenarios while the market executes its playbook using a brutal evidence-based framework. Make sense?

In summary

Your playbook makes you money and protects you from the market's playbook—which exists to take money from you.