You Feel the Need to Be Right, Right? So Here's How You Make It Your Edge

You want to be right, right?

And why is that?

It's a chicken and egg thing...

At an unconscious level, your human psyche is naturally tilted towards loss aversion. But it's what happens next...

When you first enter the world of trading you're at your most inexperienced. Correct?

So it's precisely when your trading ear tunes into what sounds good at first sight rather than what actually works or makes sense. Agree?

Bombarded with hundreds of trading systems and services promoting incredibly high winning percentages — your new logic says the best way to succeed as a trader is to be right (i.e. book winners) as often as humanly possible.

But this thinking is a trick and a trap — an expensive indulgence of your primal wiring.

Hooked, line and sinker — you now associate trading with win rates that, quite frankly, are not achieved by discretionary traders.

My best trader makes money only 63 percent of the time. Most traders make money only in the 50 to 55 percent range.

Steve Cohen — SAC Capital

(Stock Market Wizards)

But is there a way you can be right always? — You'll see in a minute.

But first: what are the following?

Failing to initiate a trade when you should have.

Getting stopped out, only to see the market move as intended without you.

Holding for a larger profit target, only to give back gains or, worse, incur a loss.

Exiting too early as the market continues moving without you.

Neglecting to add to a winning trade, missing out on substantial rewards.

Waiting indefinitely for trades to move out of the red.

Your account goes up but goes down by more.

Answer?

They're the outcomes of the wrong decision.

You see:

A win is the wrong kind of right.

The only kind of right that matters is the right decision.

How so?

When you make the right trading decisions, you succeed at trading - even when you win half the time. Want proof?

Show you in a minute. But first...

Do you think you can make the right decision most of the time?

The answer is absolutely.

Sounds like a huge promise. Right?

Well, it's not a promise.

It's just skill.

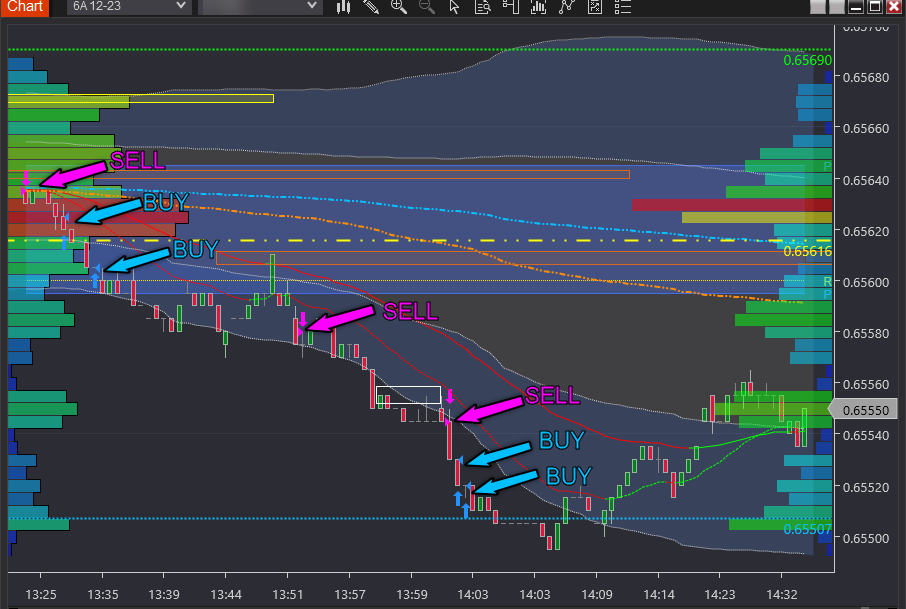

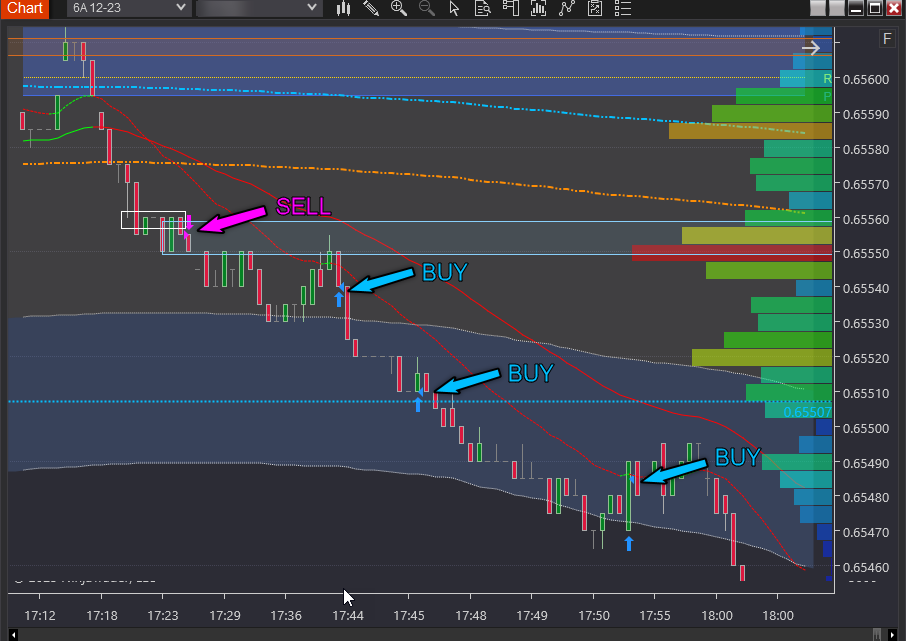

Look at the executions (the buys and sells).

Looks easy in hindsight to achieve this. Right?

And to prove it’s skill:

🔗 Watch the Decisions in Real-Time - When There Is No Hindsight Benefit.

Now...

Imagine how you'd feel if everything you did on the trading field was mostly the right decision (none of us are perfect so we make mistakes).

Isn't that when you no longer simply identify as someone who makes trades but instead identify as someone who's 'a trader'? Agree?

So when you meet someone new

And they ask. "What do you do?"

You say. "I'm a trader"

Isn't that the whole reason you started making trades to start with? So you can reach the next step to say, "I'm a trader". Correct?

And then when that someone asks you "How do you do it"

You say:

"It's skill. Skill to make the right decisions. And keep my mistakes to a minimum"

And the good news?

Skill in making the right trading decisions can be transferred. So you can choose to partner with someone who can impart this skill to you.

But a word of caution:

In my experience working with people — you're only likely to make real change if you've reached the point of no return.

The point beyond which you've invested so much financially, emotionally, personally that quitting isn't an option anymore.

If this is you, and you want to partner with someone who can transfer these skills — don't hesitate to contact the author via reply email. Your transformative journey could begin with a simple conversation.

Related reading:

🔗 See Live Trading Mentoring of the Strategies You Can Develop