You’re Not After Easy—You Want Clean and Sophisticated Trading

You don’t expect it to be ‘easy’.

But getting beyond ambiguity, frustration and the never-ending one step forward, one step back to achieve ever-green consistency—in exchange for acquiring skills—is a fair trade.

And that skill acquisition starts with a sophisticated approach:

The Playing Field: Where to Trade—and Just as Crucially, Where Not To

The playing field is a solution to:

Getting out of trades too soon.

Staying in trades too long.

Avoiding non-directional price movement that ‘'chops' traders up.

In addition:

It’s accurate. And has been reliable for two decades.

It isn’t widely known.

And in a competitive environment, where trading is about taking money—knowing what most don’t is how you achieve it.

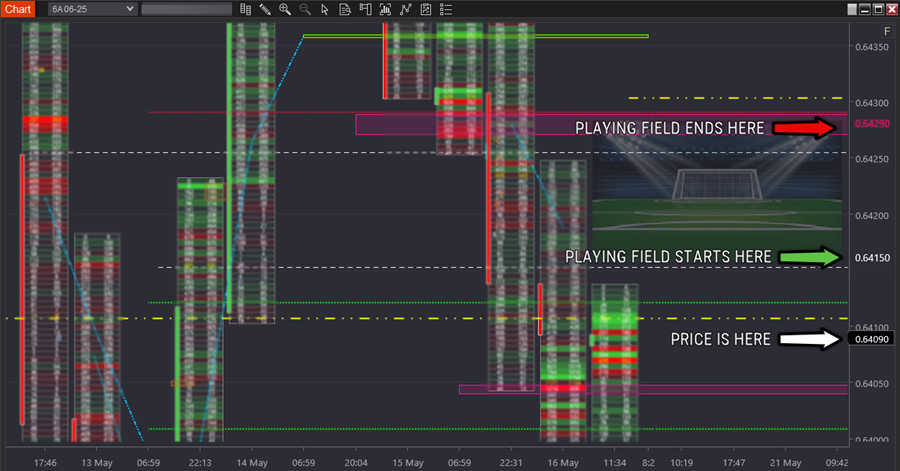

Below is an excerpt from Friday’s game plan showing a playing field—where to trade, and just as crucially, where not to.

Widely accepted: trading is counterintuitive.

The playing field is no different.

Like the playing field above, ‘getting long’ is often when price moves higher from the current level (and the reverse for entering short).

Signature Trades: Aligning Your Buys and Sells with How Price Is Travelling ‘Now’

Price travels in different ways between two points, often differing vastly from each other.

These differences are often what makes trading messy.

What could have been a winning trade is a mess of over-trading, unnecessary losses and trades that go from underwhelming to outright losing.

But recognising signature characteristics of how price travels gives you a clean, dependable solution.

When each trade has specific actions you take—there are no shades of grey—only clarity on what to do.

Actions you know by heart, having repeated them in a risk-free environment to reach competence.

Below you can see three different signature trades executed within the previously identified playing field.

It’s not as ‘easy’ as pointing to a chart and spotting a setup. Each signature trade is identified by multiple points of evidence.

But it’s worth noting—once you can identify them—they show up frequently.

Notice how the chart includes numerous simple shapes and coloured lines?

Each represents descriptions of market information you commit to memory.

It’s a sophisticated approach to developing a deep understanding of what the market is doing ‘now’—because your brain processes shapes and colours 60,000 times faster than if you were to read descriptions meaning the same thing.

Playing fields combined with signature trades produce efficient, consistent and reliable trading outcomes to last a trading career.

Skill acquisition is a small price to pay for this.