In trading—it's the icing first then the cake

Trading is icing first and then your cake.

Look at Monday's trading. What stands out?

First trades:

Final trade sequence:

First it's several "nothing-to-write-home-about" trades.

Only then does the opportunity you solved for (in your game plan) show up fully.

Tuesday? Same.

Wednesday? Same.

Today? Again—same.

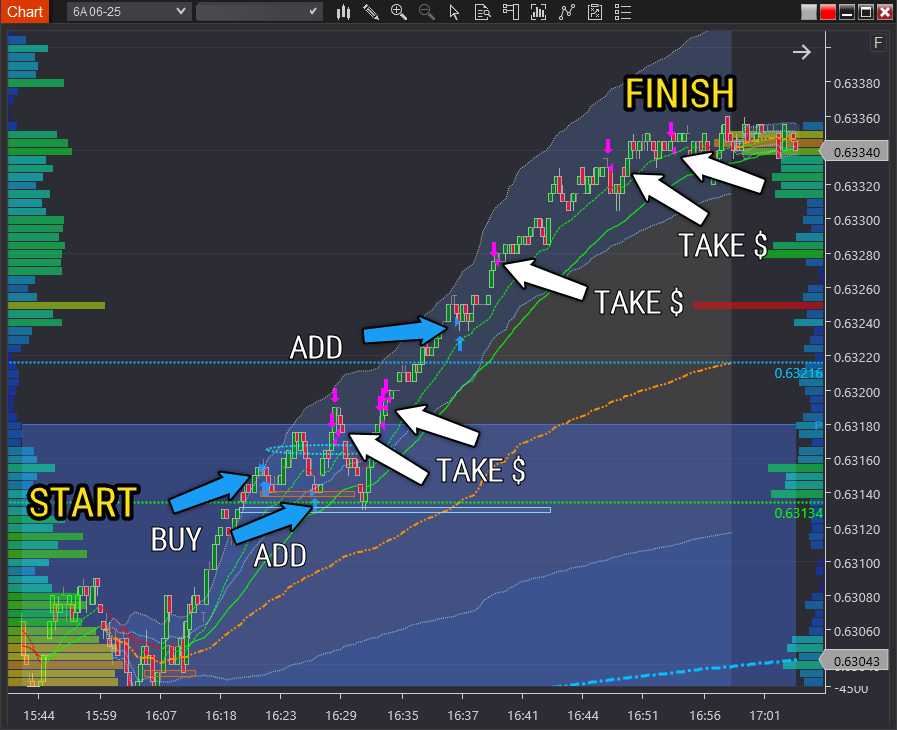

Look at today's trading.

First trades:

Final sequence:

What's happening?

When too many traders jump into the same opportunity, the market must clear the crowd.

Money always transfers from the majority to a select few who know how to play the game.

Your game plan (the opportunity for you to take money from the market) works—but at first, only a little. It's the icing.

The cake doesn't come until others:

Exit in frustration.

Bleed trying to force it.

Or better yet, flip their position in doubt.

And the long the delay between icing and cake—the bigger the cake when if finally comes.