What’s It Mean to Win Trades by Anticipating the Anticipations of Others?

Guess what happens when you anticipate others' anticipations? You'll see in a minute.

First? You're recognising and anticipating how others might think or feel about certain movements in the market before they actually occur. What happens next? Let’s go!

Read More

Are You Playing Chess or Checkers? Real Traps Trading the Wrong Game

The best way to illustrate crucial trading knowledge is via real examples. Right?

Okay:

From Tuesday's trading day you'll see two distinctly different games.

One group of traders are playing checkers.

The other group are playing chess.

Which group wins? You'll see in a minute. Let's go!

Read More

What Do You Think? Can You Think Along With an Industry-Trained Trader?

What do you know about the thinking of industry-trained traders while in a trade? Think you can think along or will you be 'out-thinked'?

Assess your thinking skills alongside an industry-trained trader and discover how your mindset stacks up.

Take advantage of this opportunity to discover your trading potential.

Read More

What’s Been Happening When You Trade Can Now Empower You

Have you ever said the following?

• The market knows if I'm long or short.

• The market knows where my stop is.

• The market knows when I enter and reverses.

• The market knows my maximum pain point.

Yes, to all of them. Right?

Guess who else says it?

Answer: Everyone

And it's the most empowering realisation you'll ever encounter in trading. Tell you why in a minute:

Read More

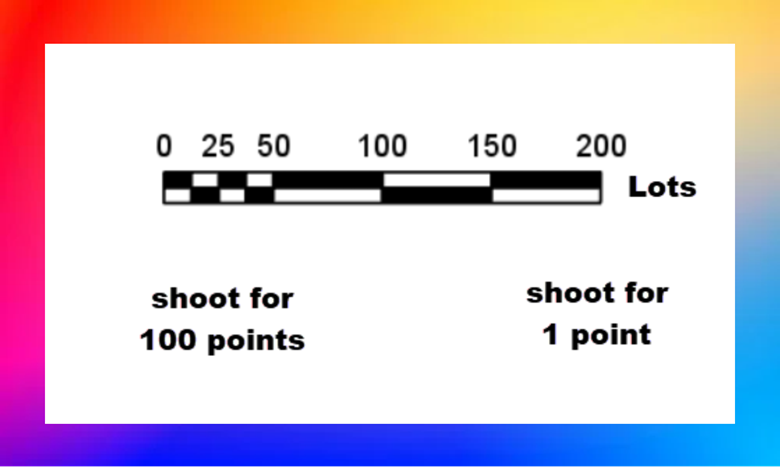

Trading 1 Lot for 100 Points or Trading 100 Lots for 1 Point - Which One Should Be You?

What does it mean to move onside?

It means the price doesn't trade at a price worse than your entry.

Just imagine if every time you entered a trade, it always went in your favour immediately.

It means you can set yourself up for greater payouts without increasing your dollars risked. It means smaller moves working for you are much more likely; plus you get paid more often.

It’s how professionals operate…

Read More

Experienced Trauma or Pain in Trading? Great! Its Your Catalyst to a Fear-Free Approach

When you suffer a devastating loss, you might think to yourself:

• "You need deep pockets to endure such hits" and/or

• "Wow! It takes real guts to withstand those blows to your account." and/or

• You may know some other stories too. Agree?

But it's not about 'guts' at all. Not even close. Did you know the best traders, including the absolute elite showcased in the "Market Wizard" series, are fearful?

Read More

Unveiling the Hidden Dynamics of Trust in Trading for Strategic Advantage

You're riding every little move up and down. Right?

"Will it move up?"

"How long's this going to take?"

"Maybe I've got this all wrong?"

"What if it gets worse?"

"Should I try to get out at breakeven?"

Every person who's ever traded has experienced this because there's only room for one hand on the mouse when you engage in the market. But...

Read More

There Are Two Types of People When It Comes to Stops. Where Pain and Rationale Interweave.

Truth is: "too often, stop loss levels are defined by pain, not rational assessment of risk" Brett SteenbargerIf you know how to spot people's behaviour as expressed through their trading - you have the foundation of a trading business that can prosper every-single-day. But there's a way your human behaviour can work for you.

Read More

Most People Do This in Their Trading – Make It Your Competitive Advantage

Know the feeling?

You enter a trade and feel your heart racing as you watch the price move underwater.

You've made a mistake and have no choice but to crystalize a loss.

Suddenly price moves as you'd planned. You jump back in with a feeling of excitement and relief. You'll make that loss back and some in a minute.

But price moves against you for a second time and it's another loss.

You're feeling drained and frustrated. Agree?

In a minute you're going to learn:

Why it happens

How you avoid it

And how you monetise it

Read More

The Potent Cocktail of Concepts That Propel Traders from Slump to Success

The following concepts create a potent cocktail of high-octane fuel to radically propel a trader from the development phase into successful trader status.

As we dive in consider how many of these points are counterintuitive. It will help you deepen your understanding of the game.

Let's go!

Read More

A Healthy Challenge Yes. But Trading a Struggle? No That’s Not the Way.

Professional traders see who the other traders are, how they trade and what makes them tick.

The stuff on the charts are tools to monetise, knowing who's doing what and why in the markets.

It’s this approach that removes the struggle from trading.

Read More

The mentor dilemma in trading: Weighing the benefits and drawbacks of seeking guidance

If you can start by defining good mentoring, you can determine if it's feasible and weed out what's unhelpful.

Your guide to choosing the right mentor

Read More