After winning $11.9 million in her 12-year poker career, Vanessa Selbst joined the world's largest hedge fund Bridgewater Associates. But her story's not unique. Several high-profile poker players have been recruited by established hedge funds. Why is that? Find out how to apply the same winning formula to your trading. Includes bonus live trading illustration.

Read MoreIs it possible?

Deep-rooted biases, unconscious habits, expectations, and survival mechanisms block your trading success.

Or maybe: You're just in desperate need of a rock-solid means to refine your trade choice?

Either or... You'll see your solution in a second. But what about the challenge most people don't know about?

Read MoreYou do all this work on analysis. But the return on effort you're putting in looking over charts, 'key levels' economic data etc. is what? But what happens if you can see more opportunities by looking at less?

Read MoreGuess what happens when you anticipate others' anticipations? You'll see in a minute.

First? You're recognising and anticipating how others might think or feel about certain movements in the market before they actually occur. What happens next? Let’s go!

The best way to illustrate crucial trading knowledge is via real examples. Right?

Okay:

From Tuesday's trading day you'll see two distinctly different games.

One group of traders are playing checkers.

The other group are playing chess.

Which group wins? You'll see in a minute. Let's go!

No different to what Harrison Ford observed of his peers - when it comes to markets - people are in a hurry.

I'm not making money if I'm not in a trade

I'm not trading if I'm not in a trade

I've set aside this time to TRADE so I better TRADE

Being in a hurry to trade makes you vulnerable. Which is how influential market people pummel you into submission. Preying on your need to enter a position. Preying on your need to make a profitable trade.

Read MoreWhat do you know about the thinking of industry-trained traders while in a trade? Think you can think along or will you be 'out-thinked'?

Assess your thinking skills alongside an industry-trained trader and discover how your mindset stacks up.

Take advantage of this opportunity to discover your trading potential.

Read MoreHave you ever said the following?

• The market knows if I'm long or short.

• The market knows where my stop is.

• The market knows when I enter and reverses.

• The market knows my maximum pain point.

Yes, to all of them. Right?

Guess who else says it?

Answer: Everyone

And it's the most empowering realisation you'll ever encounter in trading. Tell you why in a minute:

What does it mean to move onside?

It means the price doesn't trade at a price worse than your entry.

Just imagine if every time you entered a trade, it always went in your favour immediately.

It means you can set yourself up for greater payouts without increasing your dollars risked. It means smaller moves working for you are much more likely; plus you get paid more often.

It’s how professionals operate…

Read MoreWhen you suffer a devastating loss, you might think to yourself:

• "You need deep pockets to endure such hits" and/or

• "Wow! It takes real guts to withstand those blows to your account." and/or

• You may know some other stories too. Agree?

But it's not about 'guts' at all. Not even close. Did you know the best traders, including the absolute elite showcased in the "Market Wizard" series, are fearful?

Read MoreYou're riding every little move up and down. Right?

"Will it move up?"

"How long's this going to take?"

"Maybe I've got this all wrong?"

"What if it gets worse?"

"Should I try to get out at breakeven?"

Every person who's ever traded has experienced this because there's only room for one hand on the mouse when you engage in the market. But...

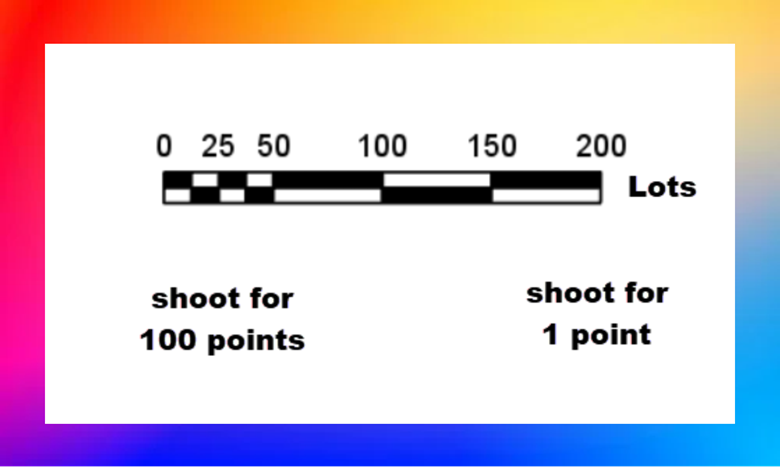

Read MoreTruth is: "too often, stop loss levels are defined by pain, not rational assessment of risk" Brett SteenbargerIf you know how to spot people's behaviour as expressed through their trading - you have the foundation of a trading business that can prosper every-single-day. But there's a way your human behaviour can work for you.

Read More